Agricultural Finance in Southeast Asia: Understanding the Plight of Smallholder Farmers

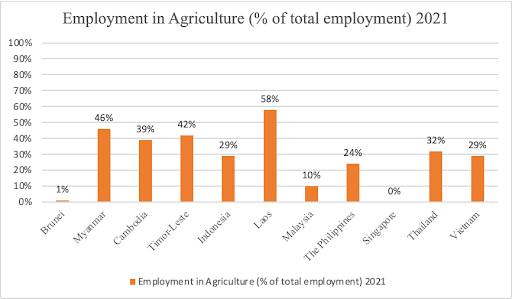

Southeast Asia, with its lush landscapes and fertile fields, is home to a staggering 100 million smallholder farmers. Agriculture here isn’t just a sector; it’s a way of life, supporting the livelihoods of roughly one-third of the region’s population (BV et al., 2021). Take a glance at the graph below, and you’ll see that employment in agriculture across Southeast Asia is extensive, touching the lives of many. Despite the substantial workforce involved in agriculture, there are numerous challenges that hinder the sector’s growth and threaten the income of smallholder farmers. The issues extend beyond just securing funding for the farmers; financiers themselves encounter hurdles when considering investments in agriculture.

To put things into perspective, smallholder farmers in Southern and Southeast Asia require a whopping $100 billion every year to satisfy their agricultural demands. Surprisingly, just one-third of the entire amount is currently being funded (BV et al., 2021). The root of the problem lies in the limited access to efficient financial institutions. Compared to large-scale farms, smallholders often achieve yields as low as 20% of their potential. This makes them unappealing to traditional banking institutions, who are wary of lending for what they perceive to be low returns. Even when loans are granted, they are usually accompanied by high-interest rates or large collateral requirements, further trapping farmers in the debt cycle.

Tackling the Input Challenge

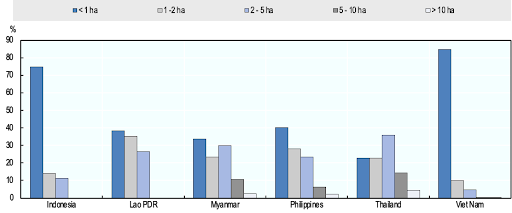

The region boasts an extensive 580 million hectares of agricultural land, but when divided among its people, it averages just 0.2 hectares per person—well below the global average of 0.6 hectares (“OECD-FAO Agricultural Outlook 2023-2032,” 2023). Consequently, fragmentation in smallholder farming across Southeast Asia presents a significant obstacle to both farmers and financial institutions. This land fragmentation limits the adoption of modern farming practices and economies of scale, which larger consolidated farms can benefit from. It also makes the sector vulnerable to climate change. Consequently, fragmented farms tend to be less productive and efficient, leading to higher perceived risks for financiers.

Vietnam faces a farming landscape where only 8% of farms exceed 2 hectares, while over 70% operate on less than 0.5 hectares (World Bank Group, 2019). To tackle this fragmentation, the Vietnamese government has pioneered the development of land rental markets. This innovation permits farmers to lease land from others, enabling smallholders to consolidate their land parcels and achieve economies of scale. This consolidation has significantly boosted productivity and financial stability. Furthermore, Vietnam’s agricultural sector has witnessed remarkable growth in machine rentals. The proliferation of machines has automated processes and reduced dependence on labor, leading to increased efficiency and financial benefits for smallholder farmers (Yamauchi, 2021).

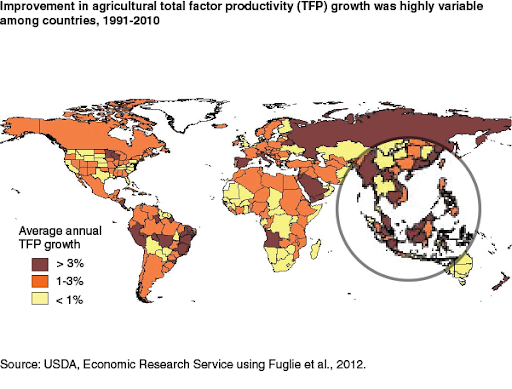

With a population growth rate of 0.9% per year, the pressure on these resources is mounting. That’s why productivity gains have become a top priority. Over the past decade, Southeast Asia has seen remarkable growth in total factor productivity, exceeding the global average at 2% annually as shown in the map above, fueling its economic progress.

The Collateral Conundrum

Take, for instance, microfinance institutions in Myanmar, which insist on land titles as collateral for loans. This might sound reasonable, but it’s highly impractical given that in countries like Myanmar and Vietnam, all lands are government-owned. Farmers possess land-use certificates, not titles, making collateralization virtually impossible for many (Brauw, 2021).

Furthermore, Indonesian and Vietnamese banks are frequently risk-conservative due to a lack of competence in screening potential creditors. As a result, lending without collateral is restricted, and banks may require collateral for loans that are not mandated by policy (Brauw, 2021). According to the IFC, the absence of collateral is an issue for the 90% of Indonesian smallholders who lack official title to their property. As a result, increasing land tenure security is critical, despite the enormous time and money necessary to accomplish this process (World Bank, 2020).

However, Southeast Asian nations have begun taking steps to address the collateral challenge. One notable initiative is the Sustainable Cocoa Production Program (SCPP) in Indonesia, which provides financial and technical support to smallholder cocoa farmers. Here, farmers have a unique advantage: they can use their cocoa beans as collateral instead of the conventional land or vehicle titles. Furthermore, for smaller loans, farmers were not required to offer any collateral, making it simpler for them to get the finance they required to invest in their cocoa crops (BV et al., 2021).

In addition, the Kredit Usaha Rakyat (KUR) is an exemplary initiative taken by the Indonesian government. It is a program in which the government provides commercial banks with subsidized capital in order to increase loan disbursement to SMEs (and farmers). Notably, the micro-KUR program doesn’t demand collateral for loans under 50 million IDR (World Bank, 2020).

Excessive Interest Rates

Table: Interest Rates for Smallholder Farmers in Southeast Asian Countries Annually:

| Sources | Myanmar | Cambodia | Vietnam |

|---|---|---|---|

| Microfinance Institutions

(MFIs) |

28% | 18% | 6-30% |

| Informal Borrowing | 72-100% | 60-240% | 72-240% |

| Development or State-owned Banks | 8.5% | 11% | 8.4-12% |

Imagine taking a loan to invest in your farm, only to find yourself trapped in a never-ending cycle of debt due to exorbitant interest rates. This is the harsh reality for many farmers in Myanmar. Traditional banks may offer lower rates to smallholder farmers with less than 10 acres of land, but the majority lack the necessary land tenure proof or credit history to access these loans. Even when collateralized, commercial banks charge farmers between 13% and 16% annually, making them hesitant to provide much-needed loans (Brauw, 2021). As a result, most agricultural financing flows through Microfinance Institutions (MFIs) or cooperatives in Myanmar, with less than 2% of commercial loans supporting the sector, despite its significant contribution to the country’s economy (BASU et al., 2020). The situation isn’t much different in Cambodia. Farmers here might face bank loan interests as high as 11%, while MFIs offer loans at over 23% interest rates. To address this, the Cambodian government imposed an annual interest rate ceiling of 18% on Rural Credit Institutions, often referred to as small MFIs, in 2017 (Heng et al., 2021). Vietnam is also taking steps to tackle high interest rates. Both VBARD (Vietnam Bank for Agriculture and Rural Development) and VSBP (Viet Nam Social Bank for the Poor) provide loans well below market averages, with VBARD charging 1% per month and VBSP going even lower at 0.7% per month. These rates are significantly cheaper than those offered by non-state-owned commercial banks. Impressively, 65% of loans to those in need come from VSBP, with another 15% from VBARD, highlighting their commitment to supporting the farming community (Brauw, 2021).

Scopes of Improvement

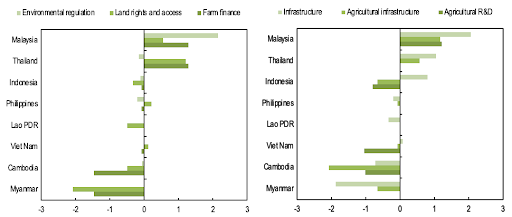

The Agricultural Growth Enabling Index (AGEI) assesses countries, comparing them with similarly developed nations across various aspects of the enabling environment. This provides insights into the factors supporting or hindering agricultural growth. Southeast Asian countries exhibit varying performance across AGEI components, but some common trends emerge. The region excels in economy-wide policies, labor markets, human capital, and abundant water resources. However, it lags in agricultural sustainability, public investment in agricultural R&D, land rights, farmer access to finance, agricultural infrastructure, and environmental regulations as shown below. These are the factors governments and relevant institutions must collaborate in to bridge the gap between farmers and financiers in order for sustainable agricultural practices nationwide.

In conclusion, Southeast Asia’s smallholder farmers, while facing considerable challenges, are witnessing a positive shift in the agricultural landscape. Efforts to improve land market rights, access, and credit availability for small-scale farmers are underway across the region. Despite these hurdles, Southeast Asia’s Total Factor Productivity (TFP) growth exceeds 3 percent annually, underscoring the resilience and innovation of its farming communities. Through collaborative endeavors between governments and institutions, the gap between farmers and financiers is narrowing, heralding a promising future for agriculture in the region.

References:

BASU, S., BRAUW, A. D., PWINT OO, K., & TOTH, R. (2020). Agricultural Value Chain Finance in Myanmar. In Australian Centre for International Agricultural Research.

Brauw, A. D. (2021, November 29). Fostering Agricultural Value Chain Finance: Lessons from Southeast Asia | Food Security Portal. Food Security Portal. https://www.foodsecurityportal.org/node/1853

BV, C. F., Mikolajczyk, S., Mikulcak, F., Thompson, A., & Long, I. (2021). Unlocking smallholder finance for sustainable agriculture: In Southeast Asia.

Heng, D., Chea, S., & Heng, B. (2021). Impacts of interest rate cap on financial inclusion in Cambodia. IMF Working Paper, 2021(107), 1. https://doi.org/10.5089/9781513582634.001

OECD. (2017). Southeast Asia: Prospects and challenges. OECD-FAO Agricultural Outlook 2017-2026.

OECD-FAO Agricultural Outlook 2023-2032. (2023). In OECD agricultural outlook.

Organization for Economic Cooperation and Development. https://doi.org/10.1787/08801ab7-en

United Nations (UN). (n.d.). Back in time: Resilience of Myanmar farmers tested as agricultural sector sinks amidst financial crisis. Myanmar. https://myanmar.un.org/en/146413-back-time-resilience-myanmar-farmers-tested-agricultural-sector-sinks-amidst-financial

USDA ERS – Growth in Global Agricultural Productivity: An update. (n.d.). https://www.ers.usda.gov/amber-waves/2013/november/growth-in-global-agricultural-productivity-an-update/

World Bank. (2020). An Exploratory Overview of Agriculture Finance in Indonesia. Indonesia Agro-Value Chain Assessment.

World Bank Group. (2016). Of Maize and Money: How to Bring Farmers into the Financial System. World Bank. https://www.worldbank.org/en/news/feature/2016/01/07/of-maize-and-money-how-to-bring-all-farmers-into-the-financial-system

World Bank Group. (2019). Vietnam Agriculture Finance Diagnostic Report. World Bank Group. Yamauchi, F. (2021). CHANGING FARM SIZE AND AGRICULTURAL PRODUCTIVITY IN ASIA. Asian Development Outlook 2021 Update: Transforming Agriculture in Asia.

Written by: Afra Nawal

Leave A Comment